How Do I Check My Credit Score In South Africa 2022

How Do I Check My Credit Score In South Africa 2022, I believe that your ultimate dream is to create a credible lifestyle for you and your family and most of the time, you need the assistance of a credit provider in building that desired lifestyle for yourself and your family.

However, in South Africa, getting credit can be tough and so many people are afraid that they might not be eligible for a loan after going through all the trouble of applying for one.

How Do I Check My Credit Score In South Africa 2022

Hence, it is essential to check your credit score to be sure of your eligibility to access your desired loan.

In South Africa, creditors access the credit report and determine the credit score of credit applicants before deciding on the eligibility status of applicants to access the requested credit.

What is a Credit Score?

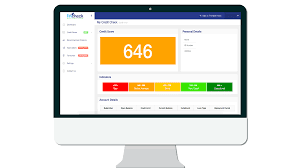

A credit score is the numeric presentation of your credit report that indicates your eligibility for a credit or loan. It is expressed as a three-digit figure used by creditors to determine the eligibility of a credit applicant.

Creditors also carry out a credit inspection on every applicant at the credit bureau and use the credit score determined to assess your level of risk as a credit applicant.

It is regarded as a personal possession and future property to many South Africans as it helps them achieve certain economic objectives. Your credit score also indicates the condition of your economic life.

How To Check Your Credit Score In South Africa

In South Africa, a considerable number of credit bureaus own and operate websites where they allow credit consumers access and check their credit scores without charging a fee.

There are four well-known websites where you can check your credit score in South Africa free of charge:

1. Experian

This credit bureau offers free credit reports and scores on their straightforward virtual portal site to all South Africans with credible IDs who are credit consumers. Their virtual portal sites are “My Credit Check” and “My Credit Expert”.

Furthermore, they provide useful suggestions to aid their clients to gain a better understanding of their credit reports to guarantee that the right credit information is reflected on their reports.

After the valid free credit report check that is accessible to all credit consumers annually, Experian charges a fee of R25 for subsequent credit report checks.

2. Transunion

This credit bureau offers the most thorough information on several aspects of credit reports to assist customers to make smart financial selections.

They are in partnership with the banks, healthcare workers, and other businesses to assist their customers to apply beneficial enterprise policies.

3. Kudough

Kudough has a vast spectrum of digital instruments to assess your economic condition to offer suitable assistance and suggestions.

Their customers enjoy savings and deluxe bids.

4. Clearscore

This credit bureau offers access to your credit report and scores and also permits you to unlock banking information.

They have a website page committed to assisting customers to understand more about their credit scores and offering valuable information and guidance for increasing their credit scores.

Credit Score Ranges and Ratings

1.Under 300

This indicates that you don’t have a credit record as you are not operating any credit account.

It is an opportunity to create a reasonable credit score.

2. 300 – 579

This score implies a low credit score resulting from a wrecked credit record caused by numerous negligence to pay several credit providers.

3. 580 – 669

This reflects a modest credit score. It further suggests a limited unfavorable effect on your credit reports.

4. 670 – 739

This scoring range infers a favorable credit score. The credit customer with this credit score range enjoys robust interest percentages but is not eligible for explicit tariffs.

5. 740 – 799

This is a sufficient credit score range that indicates lesser risk ratios to lenders and it depicts a reasonable measure of financial accountability with loans.

Prompt payments and zero negligence on credit assists you attain this credit score range.

6. 800 – 850

Consistent financial accountability depicted by constant prompt loan reprisals and surveillance helps you attain this exceptional credit score.

Finally

With this range of credit scores, you may get lesser dividend ratios on loans and mortgages because you are regarded as a meager threat for reimbursement negligence and delay based on your credit report. I hope this assists with the question – How do I check my Credit Score in South Africa?